We may receive a commission if you sign up or purchase through links on this page. Here's more information.

Investing can sound daunting for many people, but if you’re in it for the long haul, there’s no simpler way to build wealth than by investing in the stock market.

With dozens of brokerage apps popping up these days that make buying stocks and ETFs as easy as scrolling your social media feed, there’s no excuse to put off getting started with investing.

And because there is so much competition these days when it comes to investing apps, one way that many of them have chosen to differentiate themselves is by offering free stocks to new users.

For some of these companies, all you have to do is create your account with them to get a free stock.

For other companies, you must make some kind of minimum deposit in order to get your free stock or to get an additional free stock.

In the list below I tell you which stock apps are giving away free stock right now as well as the requirements for receiving the free stock.

Related: 20 Ways to Get Free Cryptocurrency

Table of Contents

How to Get Free Stocks (List)

| Broker | Bonus | Requirements | Commissions | Sign Up |

|---|---|---|---|---|

Up to $300 | Must deposit at least $20 | None. | ||

Must deposit at least $100 within 30 days | None | |||

Must create account | None | |||

Must deposit at least $100 | None | |||

Must make a deposit of any amount | None | |||

Must any amount | None | |||

Must make your first investment | Subscriptions at $1, $3, and $5 per month | |||

Must deposit at least $5 | Subscriptions at $3 and $9 per month | |||

Must make a trade within 1 month | $4.50 per trade | |||

Must deposit at least $25,000 | None | |||

Must make $25 in purchases | None | |||

Must buy your first share of stock or gift at least $10 in stocks to someone | $0.99 per trade | |||

Must create account | None |

1. Public.com (Up to $300 Bonus)

What is Public.com?

Public.com is a commission free investing platform that appeals to investors who are wanting to invest in companies that are in line with their social preferences. This caters more towards the younger generations of Millennials and Gen Zers that tend to value and prioritize social issues. The app also provides the option of fractional investing. For people who may not have enough money to invest, this is a great feature to help them get started.

Public.com, similar to social media, displays a social feed of where members can share their investments and post comments on others.

The Public.com platform is available via desktop, Apple iOS and Android App on Google Play.

My Public.com Walkthrough

If you’d like to see me walk through Public.com step-by-step, check out my YouTube video below.

How to Get Free Stocks with Public.com

While they don’t specifically offer a free stock, you can get up to $300 in free stock from Public.com by signing up through our link and inputting our Public referral code MONEYDONERIGHT in the app after you download it.

| Bonus | Available via | Fees | ||

|---|---|---|---|---|

Up to $300 | Apple iOS, Android App, and desktop | None |

2. M1 Finance ($10 Bonus)

M1 Finance is another great option for new investors, and they’re currently offering a $10 bonus. All you have to do is sign up for an account and fund your new portolio with at least $100 within 30 days.

You can start investing with a surprisingly small amount of money, and an extra $10 puts you closer to your goals. Take advantage of this offer to get a head start on your M1 Finance investing account.

What Is M1 Finance?

Like Webull, M1 Finance is an entirely free investment platform. It offers a wide range of expert portfolios to choose from, and you can also create a custom portfolio if you’d prefer. You can even set up automated investments to deduct from your account at a given interval. Unlike some of its competitors, M1 Finance doesn’t charge any fees

Additionally, M1 Finance is one of the few providers that allows you to invest fractional shares. This feature enables you to invest every cent you put in your account. Fractional shares also make it possible to invest a small amount in companies with a larger share price. M1 Finance uses two-factor authentication and military-grade encryption to protect your information.

Beyond its free investing features, M1 Finance also offers a checking account and lending services. The checking account comes with 1% cash back for Plus users.

M1 Borrow offers loans with an interest rate of as low as 7.49% for Plus users. You can even borrow using your M1 Finance investing portfolio as collateral.

M1 Plus starts at $100 for your first year before increasing to $125 annually. In addition to the benefits mentioned above, Plus users are also the first to access new M1 Finance services and applications.

My M1 Finance Walkthrough

If you’d like to see me walk through M1 Finance step-by-step, check out my YouTube video below.

How to Get Free Stocks with M1 Finance

If you’re interested in how to get free shares with M1 Finance, simply visit their website through our link. You’ll be redirected to their sign-up page to create an account. Once you’ve registered with M1 Finance and funded your portfolio, your free stock should be visible.

| Bonus | Available via | Fees | ||

|---|---|---|---|---|

$10 worth of stocks | Apple iOS, Google Android, and desktop | None |

3. Robinhood (1 Free Stock)

Robinhood is another popular commission-free trading app built for all investors. The application is currently offering a random free stock to all users who sign up using a referral link.

What Is Robinhood?

Robinhood offers a uniquely wide range of investment options including everything from cryptocurrencies to conventional stocks. With iOS and Android apps in addition to a easy-to-use website, you’ll be able to manage your portfolio from any location.

The solution offers all the tools new investors need to get started. Even if you have little or no investing experience, you’ll be able to develop strategies and quickly review results.

Robinhood Gold

Robinhood also offers a premium plan called Robinhood Gold which comes with a number of additional features. Gold users can take advantage of four helpful functions:

- Nasdaq level II market data

- Morningstar professional research

- Higher limit on instant deposits

- Investing on margin

If you’re interested in having more control over your portfolio, consider signing up for Robinhood Gold. After a 30-day free trial, you can continue your subscription for $5 per 30 days.

My Robinhood Walkthrough

If you’d like to see me walk through the Robinhood app step-by-step, check out the video I made below.

How to Get Free Stocks with Robinhood

After creating a Robinhood account through our link, you should receive free stock once your brokerage application is approved. Free shares are distributed randomly from Robinhood’s inventory, so you could get one of many different stocks.

Once the shares are deposited into your account, you can keep them for as long as you want or sell them after at least three days. Stock value ranges from as little as $5 up to $200.

| Bonus | Available via | Fees | ||

|---|---|---|---|---|

1 free stock | Apple iOS, Google Android, and desktop | None |

4. Firstrade (2 Free Stocks)

What is Firstrade?

Firstrade is a full service online brokerage firm that offers a complete list of investing products and tools to improve ones financial position through smart investing practices. From trading stocks to IRA’s, they do it all.

Firstrade is available via desktop, Apple iOS and Android App on Google Play.

How to Get the Free Bonus from Firstrade

The best part is they offer free trades and currently have a sign up bonus for a limited time.

You can also earn free stocks worth $3 – $200 by referring friends to join the platform. Every eligible account can have up to $500 in free stocks. Once it reaches that amount, you won’t be able to receive more free stocks.

| Bonus | Available via | Fees | ||

|---|---|---|---|---|

Apple iOS, Android App, and desktop | None |

5. Webull (Get up to 12 Free Stocks)

Webull is a popular platform that offers free shares of stock along with free investing tools. It provides mobile apps on both iOS and Android to give you easy access to your portfolio at any time.

What Is Webull?

Webull gives you access to a wide range of tools, and you can use it for free before deciding whether it’s worth making a deposit. Unlike some of the other options on this list, Webull doesn’t charge any fees. It also offers a convenient and intuitive mobile app, enabling you to manage your portfolio no matter where you are.

Users can take advantage of a number of other convenient features including real-time market data and helpful customer service. You can get free stock worth up to $3000 simply by joining and referring other users.

Since Webull is completely free, it’s the perfect starting point for anyone new to investing. After starting with fractional shares in two free stocks, you make an initial deposit within 10 days after opening the account and claim 4-10 more free fractional shares. You can use the application as long as you want before deciding whether to contribute more.

How to Get Free Stocks with Webull

Getting your free stock through Webull is simple. Just visit the website through our link, sign up, and deposit any amount into your portfolio. Your shares should soon be available in your Webull account. Stock rewards must be claimed within 30 days.

| Bonus | Available via | Fees | ||

|---|---|---|---|---|

Apple iOS, Google Android, and desktop | None |

6. Moomoo (Up to $1,000 in Free Stock)

What is Moomoo?

Moomoo is a commission-free stock trading app and offers apps for mobile phones(iOS and Android) and a desktop app(Mac and Windows) to provide investors the best trading experience. Moomoo does not have a monthly fee and charges no commissions on stock trades.

How to Get Free Stock with Moomoo

Moomoo gives you one free stock between $3 and $2,000 when you open an account, 10 free stock when you deposit $100, and 20 free stock when you deposit $1,000.

| Bonus | Available via | Fees | ||

|---|---|---|---|---|

Apple iOS, Android App, and desktop | None |

7. Acorns ($5 Bonus)

Acorns is an innovative investing solution with a free stock program as well as other valuable rewards. They’re currently offering a free $5 just for registering for a new account on their website.

What Is Acorns?

Acorns is directed at users who want to invest small amounts of money each month. You can set it to automatically round up purchases and put the change in your investment portfolio.

In addition to providing free shares, Acorns partners with a number of popular businesses to offer you even more rewards. These companies deposit a small amount of stock in your Acorns account whenever you shop with them.

Amazon, for example, provides Acorns users in good standing with stock equivalent to 3% of their Amazon purchase. You can get similar rewards with other well-known brands like Casper and Uber.

Acorns leverages 256-bit encryption and bank-level security to provide complete protection for your data.

If you’re interested in Acorns, you can sign up for an account at one of three subscription levels. At $1 per month, the Core plan includes basic features like rewards for purchases, automated investing, financial advice, and more. This tier is free for college students.

You can add Acorns Later to your account for another dollar per month. Acorns Later is designed for people investing for retirement and helps you manage your IRA and 401(k). You can set up recurring contributions to grow your portfolio and roll over your existing 401(k) or IRA.

Finally, users can get Acorns Spend for just $3 total per month. Acorns Spend is an FDIC-protected checking account with a number of advantages including no ATM, overdraft, or minimum balance fees. Your debit card will also integrate seamlessly with your investment account to automatically round up purchases and contribute to your portfolio.

Although Acorns charges a fee for investing, their pricing is relatively affordable and gives you several important features. Many users, for example, will receive more than the $1 monthly fee for Acorns Core by earning Found Money for shopping with Acorns’ partners.

How to Get Free Stocks with Acorns

Visit Acorns through our link and you’ll be well on your way to a successful portfolio. You’ll be credited as soon as you visit the website and create a new account.

| Bonus | Available via | Fees | ||

|---|---|---|---|---|

$5 to invest in stocks | Apple iOS, Google Android, and desktop | Subscriptions at $1, $3, and $5 per month |

8. Stash Invest ($5 Bonus)

Stash Invest is a popular investment application that allows users to start investing with as little as $5. It gives you the option to purchase fractional shares, making every cent count and enabling you to buy partial shares in companies with a high share price.

What Is Stash Invest?

Rather than receiving shares in Stash Invest itself, users earn shares of different companies depending on the companies you buy from. Depending on your subscription, you’ll also have access to a number of additional features. Users at all tiers can earn stock rewards on their purchases.

Beginner plans are intended for new investors and cost just $1 per month. You’ll have access to debit and personal investment accounts along with financial education resources through Stash Invest.

At $3/month, Growth subscriptions add features like tax benefits for retirement investing along with fractional shares. Finally, Stash+ plans ($9/month) include the full set of tools including investing accounts for two children, a metal debit card with double rewards, and a monthly market insights report.

Given its flexible plans, Stash is a great option for both new and experienced investors with a variety of goals. If you’re just interested in investing, a Beginner subscription provides all the tools you need to get started. Upgrading to Growth is better for users who want to invest for retirement or take advantage of fractional shares.

The Stash+ plan is more expensive than the other two, but keep in mind that you could get that money back (and more) by earning double rewards with Stash’s debit card. You’ll also be able to make smarter investments using Stash+ exclusive market insights reports.

How to Get Free Stocks with Stash Invest

With Stash Invest, redeeming your free shares is as simple as making an account and buying from the right brands. You can start investing with as little as $5, so it’s the perfect option for new investors.

| Bonus | Available via | Fees | ||

|---|---|---|---|---|

1 free stock | Apple iOS, Google Android, and desktop | None |

9. Tornado (1 Free Stock)

What is Tornado?

Tornado (previously NVSTR) is a trading platform that is built around an investing community that shares their knowledge and wisdom. They seek to invest by sharing ideas and recommendations with each other.

They offer a tool called Portfolio Optimizer which relies on research to align your portfolio with your risk tolerance and goals

One downside to Tornado is that they do not offer free trade commissions like so many other investing platforms. They charge $4.50 per trade, but you can sign up for an account for free and this makes you eligible for their free bonus stock.

Tornado is available via desktop and mobile site.

How to Get Free Stock with Tornado

To earn the free bonus stock valued between $5-$1,000, just sign up and make a trade within 1 month of opening an account. You will have to hold this free stock for 12 months before you can sell it, but investing is typically a long term game anyways. The longer you hold a stock, the more potential it has to increase in value.

| Bonus | Available via | Fees | ||

|---|---|---|---|---|

$5-$1,000 worth of stock | Apple iOS, Google Android, and desktop | $4.50 per trade |

10. Schwab ($100 to 1,000 Bonus)

Schwab is one of the most well-known investing platforms, and their current referral offer is the perfect opportunity for new users. After signing up for a new account through this article, you’ll receive a $100 to $1,000 credit after 45 days. The account creation process is simple and shouldn’t take you more than ten or fifteen minutes.

What Is Schwab?

Schwab is one of the largest brokerages and banks in the United States, with both digital access and physical locations. They provide investing tools along with a number of other financial services.

Schwab offers a wide range of tools and accounts for traders with different needs. It provides recommendations based on expert data along with available one-on-one consultations.

The website also gives users access to more than 300 videos and articles to help new investors learn. With tools for every investor, you’ll be able to stick with Schwab and start using new features as needed.

Schwab covers all users with a 100% guarantee for all unauthorized account activity. You won’t have to worry about losing your funds through fraud or other unforeseen circumstances.

Although Schwab doesn’t charge fees for creating an account, you will have to pay trading commissions. Stocks and ETFs that aren’t included in ETF OneSource, for example, cost $4.95 per trade.

How to Get Free Stocks with Schwab

Getting your free stock (worth $100 to $1,000) with Schwab is quick and easy. Just access their website, sign up for an account with our promo code (REFERJ6BHF32J), and wait for your free bonus!

Numerous Schwab account types are eligible for the offer, so most investors should be able to take advantage. There’s even a 24/7 live chat to help you determine which plan is right for you.

| Bonus | Available via | Fees | ||

|---|---|---|---|---|

$100 to $1,000 in free stock | Apple iOS, Google Android, and desktop | None |

11. TD Ameritrade ($350-$2,500 Bonus)

What is TD Ameritrade?

TD Ameritrade is a well known brokerage that is currently being bought by the Charles Schwab brokerage firm. They offer commission free trades, similar to Robinhood and Webull.

TD Ameritrade is available via desktop, Apple iOS and Android App on Google Play

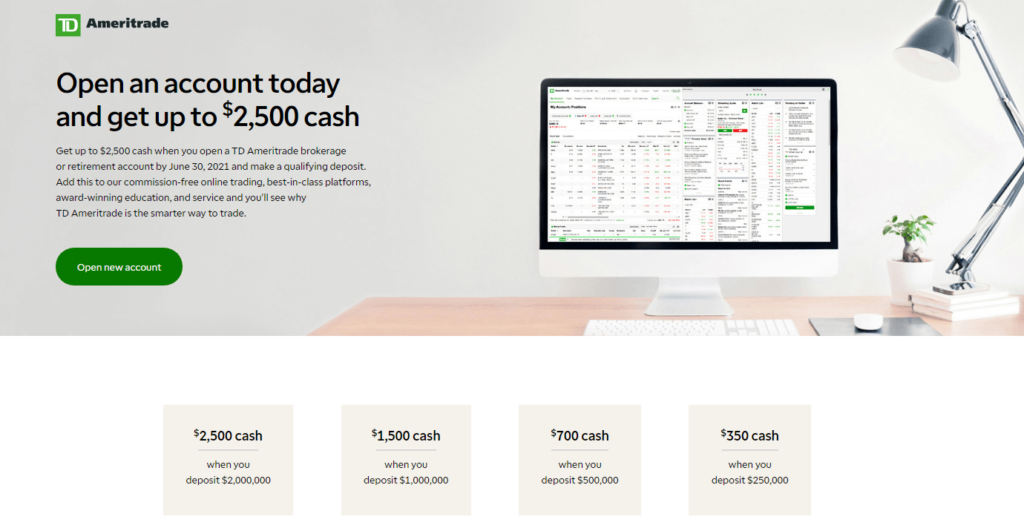

How to Get the Free Bonus from TD Ameritrade

They don’t have way to earn free stock, but they do offer a generous sign up bonus.

- $350 bonus with a deposit of $250,000 – $499,999

- $700 bonus with a deposit of $500,000 – $999,999

- $1,500 bonus with a deposit of $1,000,000 – $1,999,999

- $2,500 bonus with a deposit of $2,000,000 or more

While their sign up bonuses are much more than any others out there, they also require a much larger amount of money deposited into the account before you can qualify for the bonus. The bonus ranges from $350 – $2,500 depending on how much is deposited.

| Bonus | Available via | Fees | ||

|---|---|---|---|---|

$350 – $2,500 | Apple iOS, Android App, and desktop | None |

12. iConsumer (100 Free Shares in iConsumer)

iConsumer is a unique business that uses a different model from the other companies on this list. Rather than providing free stock in other businesses, the brand gives its users shares in iConsumer itself.

They’re currently running a great offer of 500 free shares after you make $25 in purchases. Shares most recently traded at 11.9 cents each, so this is a great way to start your portfolio.

What Is iConsumer?

iConsumer is a rewards-based shopping application that offers shares in exchange for purchases at select businesses. Some of the most popular brands include eBay, Walgreens, Overstock, and Staples.

With iConsumer, every purchase adds a little to your investment account. Those rewards will make a big difference over time, especially once you start using the app regularly. Mobile apps are available on both iOS and Android.

iConsumer will ask for your SSN if you want to issue and transfer stock or earn more than $600 in bonuses, but these are standard federal requirements. You can trust the application to take every possible precaution with your information.

Since iConsumer isn’t a conventional investing account, your funds aren’t protected by the SIPC. Of course, that protection likely wouldn’t matter–if the company did go under, your shares probably wouldn’t be worth much anyway.

How to Get Free Stocks with iConsumer

iConsumer is currently offering 500 free shares to anyone who makes $25 in purchases using the application. There’s no catch — simply download iConsumer through our link and keep shopping with your favorite brands.

From there, you’ll continue earning more stock every time you buy something with a partner brand. 500 free shares is a great way to start investing without taking on any risk.

| Bonus | Available via | Fees | ||

|---|---|---|---|---|

500 free shares | Apple iOS, Google Android, and desktop | None |

13. E-Trade (EXPIRED)

What is E-Trade?

E-Trade is an investing platform that provides educational resources which can assist one with learning how to properly invest.

From choosing between the many different investing options, doing research and diversifying one’s portfolio, E-Trade helps with it all. Not to mention they offer retirement planning to their investors and in person classes in certain areas.

E-Trade has no minimum investment requirement and is free to use. They offer three platforms:

- Power E-Trade offers investors real-time data and studies.

- E-Trade Web provides live market commentary and stock analysis.

- Trade Pro gives you strategy scanners and back-testing.

E-Trade is available via desktop, Apple iOS and Android App on Google Play.

How to Get the Free Bonus from E-Trade

| $50 | $5,000–$9,999 |

| $100 | $10,000–$19,999 |

| $150 | $20,000–$24,999 |

| $200 | $25,000–$99,999 |

| $300 | $100,000–$249,999 |

| $600 | $250,000–$499,999 |

| $1200 | $500,000–$999,999 |

| $2500 | $1,000,000+ |

Get E-Trades sign up bonus ranging from $50-$2,500 by opening an account and depositing at least $5,000 and up to $1 million or more. How much you contribute will determine how much of a bonus you can receive.

| Bonus | Available via | Fees | ||

|---|---|---|---|---|

$50 – $2,500 | Apple iOS, Android App, and desktop | None |

Free stocks are a unique opportunity that comes with no risk at all, and they’re a great option for anyone new to investing. These are some of the best options currently available, but there are a number of other brands offering free shares of stock.

If you’re wondering how to get free stocks, you can’t go wrong with any of the applications on this list. Even if you can only contribute a few dollars a month to your investments, that money will still make a difference in your portfolio. Don’t be afraid to start investing slowly until you feel more confident in your strategies and long-term financial goals.

Investing is always unpredictable, and it takes every investor time to grow more comfortable with trading.

14. Stockpile (EXPIRED)

What is Stockpile?

Stockpile is an investing platform that lets you invest in fractional shares of stocks and ETFs. They also allow you to gift stocks to people, enticing them to invest using Stockpile themselves.

They don’t charge any monthly fees nor do they require an account minimum, however they do charge $.99 per trade.

Stockpile is available via desktop, Apple iOS and Android App on Google Play

How to Get Free Stock from Stockpile

To claim the free stock, buy your first share of stock or gift at least $10 in stocks to someone. Once it goes through you can expect to see your free stock valued at $5.

| Bonus | Available via | Fees | ||

|---|---|---|---|---|

$5 worth of stock | Apple iOS, Android App, and desktop | $0.99 per trade |

15. Dough (EXPIRED)

What is Dough?

The Dough app is an excellent platform for investors. Dough has no account minimums, no monthly fees, and no commissions on stock trades.

How to Get Free Stocks with Dough

Dough is pretty straightforward, you sign up, and you get a free stock, you don’t have to make a deposit or anything, the stock I got was really inexpensive though, it was for natural gas company Tellurian Inc with a value of three dollars and fifty-seven cents when Dough gave it to me.

| Bonus | Available via | Fees | ||

|---|---|---|---|---|

Apple iOS, Android App, and desktop | None |

Frequently Asked Questions

- Why Do Companies Give Away Free Stocks?

- How Can I Get Free Stocks?

- Is My Data Secure?

- Why Should I Start Investing?

Author:

Logan is a practicing CPA and founder of Choice Tax Relief and of course Money Done Right. After spending nearly a decade in the corporate world helping big businesses save money, he launched his blog with the goal of helping everyday Americans earn, save, and invest more money. Learn more about Logan.

Robinhood Investing.

Fake prices, ripped me off at the BUY and can’t sell. Then the 3 outages affected my account even more. FAKE 1-800 #, FAKE PRICES, FAKE CUSTOMER(unless you are setting up your account), CARE, ENDLESS HELPLESS EMAILS, BUG TARGETS DAYTRADER, GLITCHES. I tried to get them to help, but they didn’t budge.

I contacted……

SHUMAKER, LOOP, and KENDRICK, LLP.

THE LAWSUIT IS THE ONLY WAY.

I too have fallen into there trap . It’s a scam most of it’s legit but then they begin to tweak everything once your in.

Over Price , blocked stocks, slow network.

Pla contact me via email if you need any assistance in the lawsuit or can add me in . Cause its ridiculous